Navigating opportunities: the resilience and potential of the Alternative Investment Market

This article was written by Alysha Goddard, and was originally published by Canaccord Genuity Wealth Management (CGWM).

The Alternative Investment Market (AIM) has had a turbulent time since 2021, amongst tighter monetary policy, an uncertain economic outlook, and the rise of consumer price index (CPI) inflation. AIM is the London Stock Exchange’s market for small and medium-sized companies, and since its inception in 1995 it has grown to become the world’s most successful market for high-growth companies.

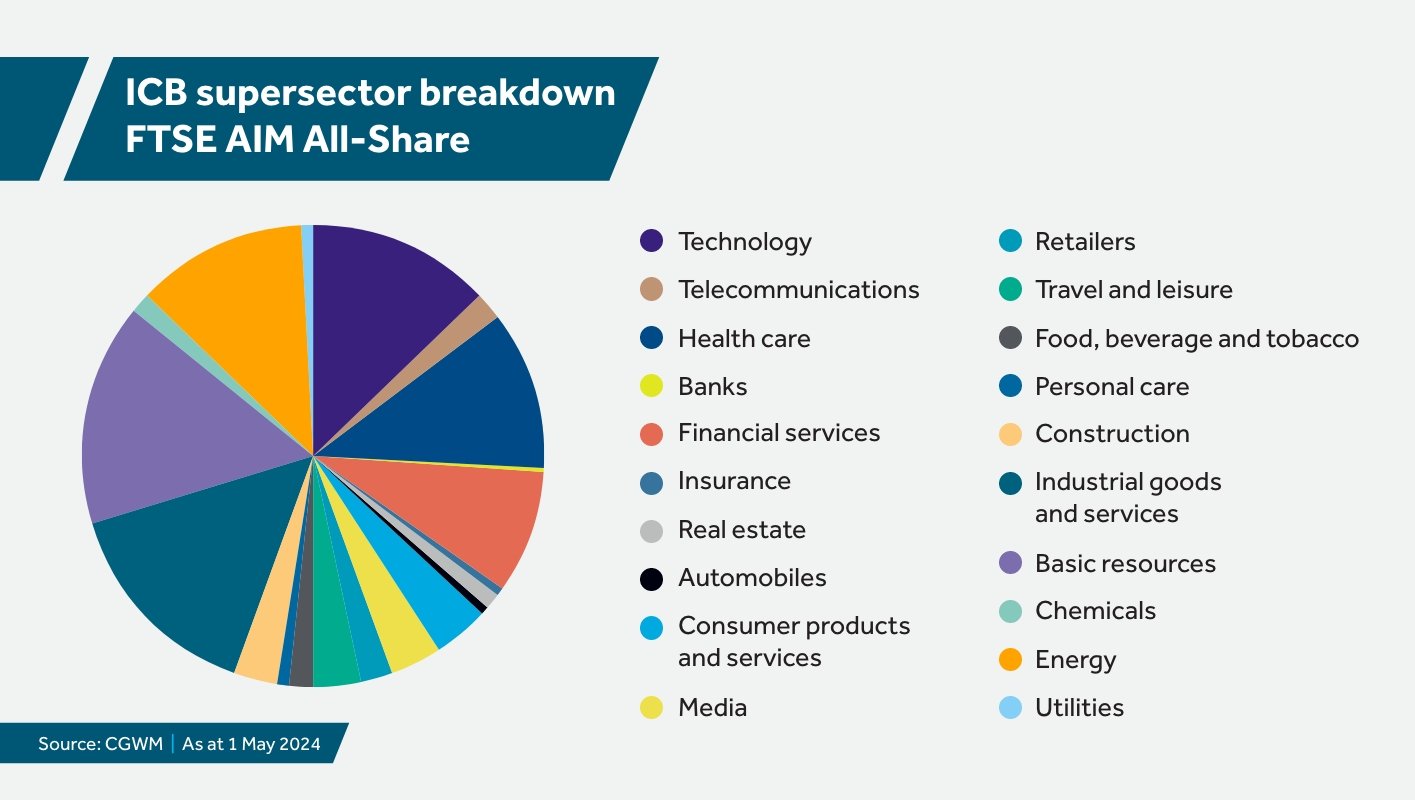

During this time, over 4,000 innovative entrepreneurial companies, representing a vast array of countries and sectors, have raised more than £122bn on AIM, supporting smaller companies to attract the capital they need for expansion.

Volatility amid uncertainty has been the underlying plot of the last couple of years, which has led to the number of AIM-listed companies to dwindle down to historical lows. As of 29 December 2023, there were 660 companies listed across AIM, compared to nearly 1,700 just before the 2008 financial crash.1

2

Are AIM companies dwindling?

In the height of the COVID-19 pandemic in 2021, 56 companies were newly-listed on AIM. In 2023, a dismal two IPOs (Initial Public Offerings) were completed. While the number of IPOs on AIM seems disappointingly low, it is not too dissimilar a story across the UK main markets. The number of companies listed on the London Stock Exchange has dropped by 42% since the highs of 2008. Many UK companies are instead looking across the pond, to New York, to list. This was the story of Abcam Limited, the Cambridge-based biotech company that moved its listing to the Nasdaq (US technology index) in April 2022.

Source: Bloomberg

Market resilience

Despite numerous economic challenges of late and these dwindling IPO figures, opportunities in the Alternative Investment Market have persisted:

- Mergers and acquisitions: AIM investors have found returns through takeovers by private equity firms and international conglomerates, recognising the ‘cheap deals’ the UK market offers

- Recovery resilience: amongst the global economic turbulence of the past few years, many AIM companies demonstrated resilience during the recovery phase – though we continue to avoid the more speculative areas like mining, oil and gas, and commodity exploration

- Active over passive: Active stock pickers have proven their worth in this market and have broadly made a positive impact to portfolio returns over the long term – especially in the small cap space.

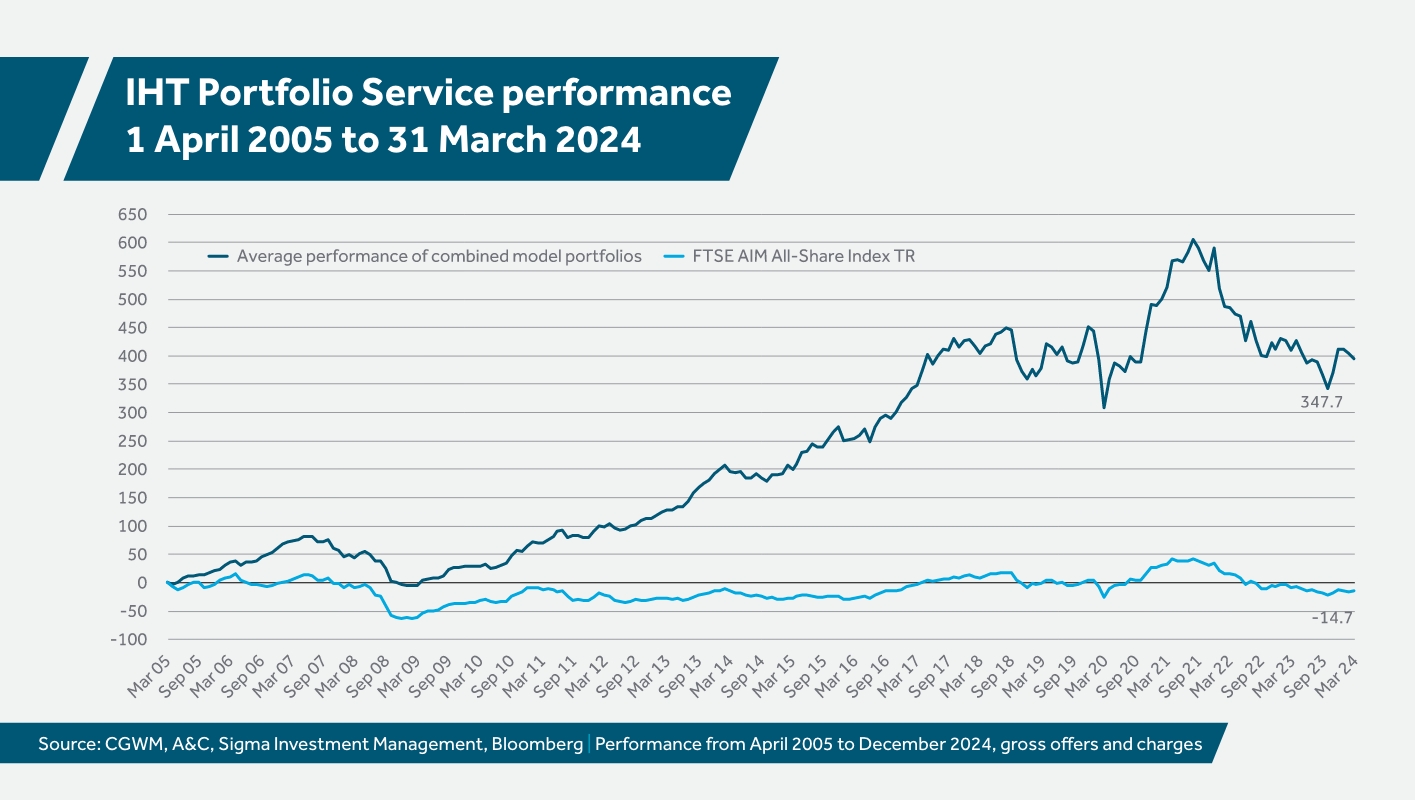

As part of Canaccord Genuity Wealth Management (CGWM), our specialist team of AIM experts have endeavoured to make the most of these opportunities for Adam & Company clients. Our AIM performance has a strong long-term track record – since our AIM portfolio investments began in April 2005, we have returned over 410% vs the AIM All-Share Index – down -14.7% as of March 2024 – and our tactics have proved particularly successful during the turbulence of the last year. In 2023, while the AIM All-Share Index was down -6.4%, our portfolio made a positive return of 0.3% – outperforming the market by 7.3%.

3

Putting the AI in AIM

At the peak of its popularity, the dominant theme of 2023 across the entire global market capitalisation spectrum was artificial intelligence (AI), and AIM was by no means immune. It’s certainly been a major talking point over the past year: according to Reuters’ analysis, the phrase ‘AI’ was mentioned over 800 times, on 76 calls with S&P 500 companies, during their Q2 2023 results. This trend has only risen in the months since.4 It’s not just companies recognising the influence of AI: the UK Prime Minister Rishi Sunak hosted the AI Safety Summit in October, to highlight the importance of recognising AI in public policy.

In this AI-defining era, many AIM companies are being dubbed as the future ‘winners’ and ‘losers’, based on their inclusion of, and adaptation to, the technology (and not just within the technology sector itself). Craneware plc, for example, has been using AI in its healthcare data analytics products for years, with over 12,000 hospitals, clinics, and pharmacies in the US relying on their services.

With AI undoubtedly here to stay, and the potential for a continuing upwards trend in its influence into 2024, it seems that those willing to encompass AI into their offerings have found a catalyst to resilience against the turbulent economic backdrop upon which AIM currently lies. Not only does it make these companies seemingly more resilient, but AI may prove to be a significant driver within AIM for potential growth opportunities over the next few years.

Can AIM still reduce my IHT bill?

The Alternative Investment Market offers more than just the opportunity to invest in growing new companies – it can also help to mitigate inheritance tax (IHT) on your estate. This is something we have previously explored, and is often seen as a huge advantage to an otherwise risky investment option.

Despite the rumours of potential changes to IHT, the Autumn Statement in November 2023 revealed that IHT receipts are up by 12% in the first seven months of the 2023/24 financial year compared to the previous year.5 The rise implies a growing significance of IHT within the UK fiscal budget, despite affecting less than 4% of the population.6 Notwithstanding the political polarisation surrounding IHT, the Spring Budget delivered in March 2024 confirmed that there would be no change to inheritance tax for AIM companies, and it is unlikely that policymakers will alter this tax amidst the buzz of an election year.

The light at the end of the tunnel

While it is fair to say that AIM has encountered its fair share of turbulent times and uncertain economic outlooks since 2021, there are reasons to be optimistic about the resilience and potential opportunities that can be found here.

At Adam & Company, our experts in the Alternative Investment Market can help you make the most of the opportunities on offer. Our IHT Portfolio Service is made up wholly of AIM shares, which, after two years, can be exempt from IHT. This will reduce the amount of tax your family will have to pay on your estate.

Thanks to our relationship with CGWM, we have access to a breadth and depth of knowledge in AIM stocks. We have a joint team of specialist investment analysts, and a dedicated small-cap committee, that are continually monitoring for breakthrough smaller companies and for notable movements in the Alternative Investment Market.

Speak to one of our AIM experts

If you’d like to know more about how AIM companies can be included into your investments, including in our IHT Portfolio Service, please contact our team.

Find this useful? You may also be interested in:

Speak to our team in Edinburgh

If you are new to wealth management and would like to learn how this can benefit you, we can put you in touch with our team of experts that can help.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. It is not suitable for everyone.

This service should be regarded as high risk, as it is exclusively focused on equities. The portfolios are wholly invested in small capitalisation stocks. These companies are therefore more volatile and, while they can offer great potential, growth is not guaranteed. It is important to note that this should be seen as a long-term investment.

The current inheritance tax rules and tax treatment of AIM shares may change in the future. We strongly recommend that clients discuss their financial arrangements with their tax adviser before investing, as the value of any tax reliefs available is subject to individual circumstances.

Specific risks of the IHT portfolio service investing in AIM-listed companies include the potential volatility and illiquidity associated with smaller capitalisation companies. There may be a wide spread between buying and selling prices for AIM-listed shares. If you have to sell these shares immediately you may not get back the full amount invested, due to the wide spread. AIM rules are less demanding than those of the official list of the London Stock Exchange, and companies listed on AIM carry a greater risk than a company with a full listing. The current inheritance tax rules and tax treatment of AIM shares may change in the future. In addition, you must be prepared to hold your shares in AIM-listed companies for a minimum of two years or these assets will be considered part of your estate in the IHT calculation.

1 As at 4 January 2024: FTSE AIM All-Share FTSE overview | London Stock Exchange

2 As at 29 February 2024

3 CGWM, Adam & Company, Psigma Investment Management and Bloomberg. Performance from April 2005 to 30 September 2023, gross of fees and charges

4 Reuters: Companies double down on AI in June-quarter analyst calls | Reuters

5 IHT receipts up 12% year-on-year ahead of Autumn Statement (professionaladviser.com)

6 IFS Wealthiest 1% would get half the benefit of scrapping inheritance tax, with an average tax cut of £1 million | Institute for Fiscal Studies (ifs.org.uk)

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.