Why healthcare and infrastructure sectors are still key portfolio components

This article was written by Richard Champion and originally published by CGWM.

Both healthcare and infrastructure stocks had a mediocre 2022 and, for the most part, a difficult 2023. However, we’re pleased to say we believe the case for investment in both remains almost entirely as strong as it was before the period of poor performance.

Looking forward to some positive investment news in 2024

For investors, most of 2023 was deeply disappointing. This was unexpected because normally, after the steep falls in both equity and bond markets seen in 2022, you’d expect a more robust recovery over the following year.

As discussed in our first Investment Outlook of 2024, there was a positive recovery in equity and bond markets in the last two months of 2023, but returns were limited to a narrow set of companies, predominantly the ‘magnificent seven’ US technology giants.

Part of the disappointment was due to poor performance from two of the long-term investment themes we have supported for a while: healthcare and infrastructure. We have checked back on the rationale for those themes, revalidated the investment case and identified what happened.

Investing in healthcare

Healthcare investments have long played a pivotal role in our discretionary portfolios and we believe this should continue. This belief is supported by the following long-term demographic drivers:

- An ageing population in developed markets is increasing pressure on health systems and driving innovation in more efficient and effective treatments

- Rising affluence in emerging markets is widening access to healthcare but also increasing demand, as that affluence is unfortunately also leading to an increase in previously ’western’ afflictions such as obesity, heart disease and diabetes

- The spread of innovation in pharmaceutical and biotechnology companies, such as the much-hyped launch of anti-obesity treatments, and in new therapeutic areas that are even looking into arresting the ageing process.

These drivers will boost demand for drugs, orthopedic devices, healthcare services and other revenue generators for years to come. We gain exposure for our client portfolios by investing in third-party funds like the Polar Capital Healthcare Blue Chip Fund. We spend a lot of time analysing the market to select funds like this, as they provide a fantastic ready-made opportunity to invest in a diverse range of healthcare companies and innovations. The Polar Fund is led by a highly experienced investment team, including experts with a medical background, and has a strong track record over the long-term.

As well as selecting best-of-breed thematic funds, we have an expert team of in-house equity investment analysts. When we are strongly convinced by a specific company, we will often invest directly in their stock on behalf of our discretionary clients. In healthcare, we currently favour individual company shares, including AstraZeneca, Novo Nordisk, Thermo Fisher Scientific, Stryker and Danaher.

Investing in infrastructure

Our belief in infrastructure investment is based on four main drivers: ageing infrastructure, green energy, electric vehicles and geopolitical stress.

1. Ageing infrastructure

Vast quantities of existing western infrastructure is crumbling due to decades of under-investment. Famously, the US Army Corps of Engineers estimates that 42% of bridges in the United States are over 50 years old and over 46,000 are structurally deficient. Over the years several have collapsed, often with tragic consequences. There is a pressing need to rebuild roads and bridges, on which – surprisingly! – both US political parties agree.

2. Green energy

The transition to a green energy system requires massive investment in new forms of power generation, such as wind, solar and hydro. There will also need to be a vast investment in the power grid to make it fit for these new forms of energy supply, many of which are intermittent and therefore more complicated to integrate.

In 2022, the US passed the CHIPS (‘Creating Helpful Incentives to Produce Semiconductors’) and Science Act. This injected several hundred billion dollars of subsidies and research grants into a range of areas, including accelerating the adoption of zero-emissions technologies.

Other countries, including the UK, are instead extending their deadlines for achieving net-zero carbon emissions. However, we don’t believe this extension outweighs the significant opportunities offered by this likely multi-decade investment in infrastructure.

3. Electric vehicles

A transition to electric vehicles will create huge pressures on both the generation and distribution of energy. According to UK e-mobility service provider Zapmap, at the end of 2023 there were around 53,900 public charging points in the UK (and another 680,000 or so domestic ones). A previous 2021 study by the UK Society of Motor Manufacturers and Traders, a trade body, estimated that the UK will need around 2.3 million public charge points by 2030.

That means adding new points at a rate of 880 per day until the end of 2030. This is approximately 30 times the current rate of deployment and will create enormous stress on our electricity network, demanding a huge investment over the coming years.

4. Geopolitical stress

Heightened geopolitical stress is driving a boom in so-called ‘re-shoring‘. This is when critical industrial capacity is relocated from places like China, where security of supply may not be guaranteed, to countries closer to home, such as Germany.

We prefer to access this strong long-term theme through third-party funds, to give us exposure to a range of different aspects of the sector. One typical example is Clearbridge Global Infrastructure Fund. The management team is vastly experienced and their track record, in particular over difficult market periods, shows the benefits of their focus on conservatively-run companies and strong investment process.

What factors have affected the performance of healthcare and infrastructure?

Based on this evidence, it is obvious that there is still an extremely favourable long-term environment for both healthcare and infrastructure. So why have they underperformed?

Firstly, we must acknowledge the amazing run we’ve seen over the last 15 months from the ‘magnificent seven’ technology titans in the US. Today these seven companies account for well over 17% of the global equity market. On average, during 2023, these giants also rose in value by well over 100%, meaning that pretty much every other stock looked pedestrian at best and poor at worst compared with them. Healthcare and infrastructure have been no exception to this unflattering comparison.

However, the driver that has hit healthcare and infrastructure hardest has been the rise in interest rates. Traditionally, both these themes are seen as defensive areas of the equity market and are occasionally described as ‘bond sensitive’. As bond yields rose (and prices fell) from the end of 2021 through to the last quarter of 2023, their connection to these sectors acted as a major handicap to performance, even though in healthcare the emergence of anti-obesity drugs helped to mitigate this headwind.

Taking advantage of cheaper sector valuations

This leaves us in an interesting position. We believe the longer-term drivers that lie behind the attractive fundamentals of healthcare and infrastructure haven’t deteriorated. However, these sectors have suffered from weak performance and this probably means they’re cheaper than they were before, making them extremely attractive now.

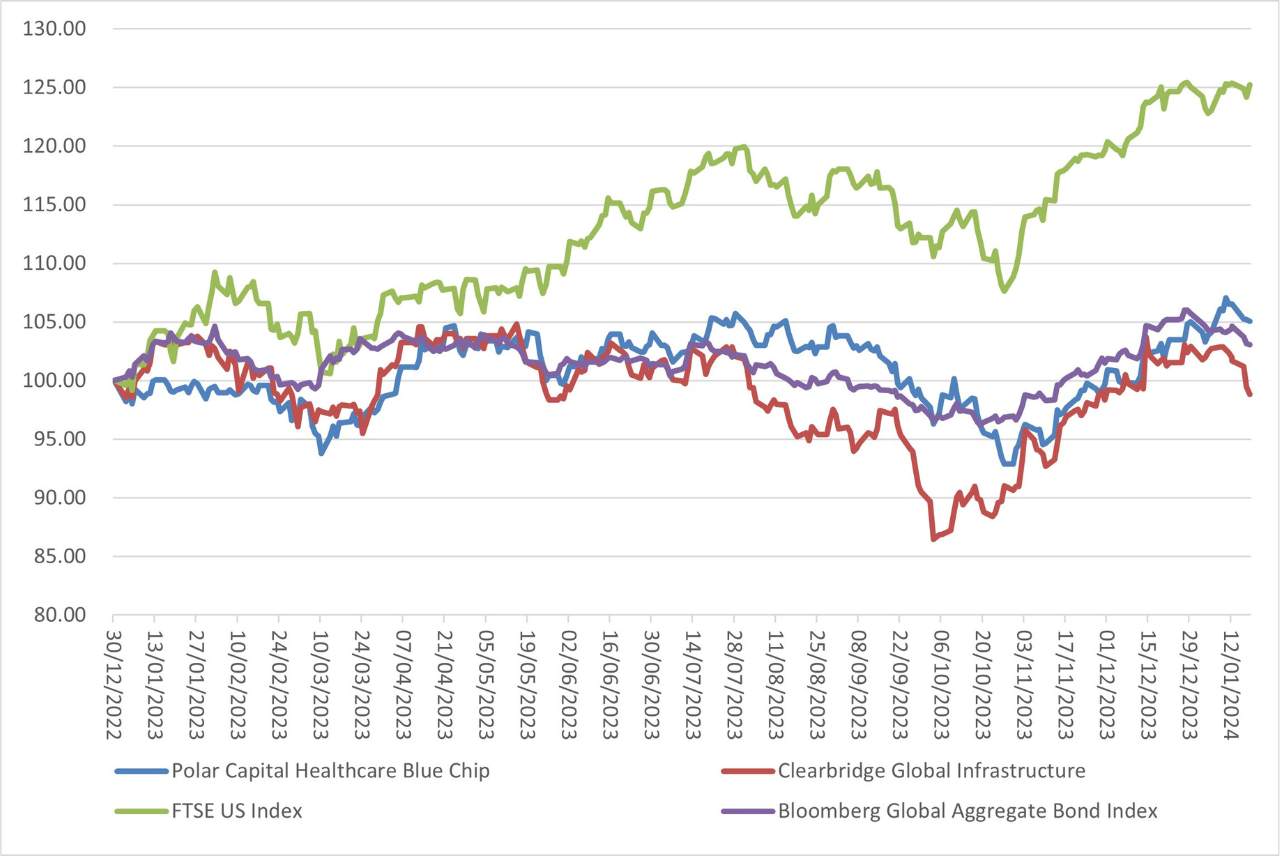

In conclusion, our view is that inflation will continue to subside (at least at the beginning of 2024), central banks will be in rate-cutting mode from the second quarter of this year, and bonds are solid value. This is a positive environment for infrastructure and healthcare, as their performance has mirrored bonds (fig 1) and we won’t be the least bit surprised if these sectors, and in turn our portfolios, benefit from these mitigating factors.

Fig 1: Infrastructure and healthcare behaving like bonds, not the magnificent seven

Source: CGWM, Bloomberg

If you would like to find out more about the healthcare and infrastructure sectors and how they feature in your portfolio, please contact your usual Account Executive, who will be delighted to help.

Any questions?

If you have any questions about the current market and economic environment or your asset allocation within your portfolio, please get in touch with us.

For further information on any of the terms used in this article please see our glossary of investment terms.

Investment Outlook August 2024

Read our latest Investment Outlook to discover if election fever will help or hinder investment opportunities?

You may also be interested in:

New to Adam & Company Wealth Management?

If you are interested in finding out what the latest investment outlook means for you, we can put you in touch with an expert that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Adam & Company makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Adam & Company is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Adam & Company is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.