Is cash flow modelling right for you?

This article was written by Hazel Bowen, one of our London-based technical specialists, and was originally published by Canaccord Genuity Wealth Management (CGWM).

“If you fail to plan, you are planning to fail.” This quotation, often attributed to Benjamin Franklin, neatly summarises why planning your cash flow can be a key tool towards making your financial objectives a reality.

You may already be an Adam & Company wealth planning client and want to know whether your plans are on track – or you may simply be thinking about consulting our expert independent planners at some stage. Either way, cash flow planning is a great method to use to look at the various ways in which your financial future could pan out.

What is cash flow modelling?

Essentially, cash flow modelling (also known as cash flow planning) is a way of showing how your financial situation could change over the years, taking into account your assets, liabilities, income, expenditure and plans for the future. It can be used for a range of purposes, as we will see later in this article.

Many people associate cash flows with business planning. Indeed, a finance director is unlikely to be in the role for long without a credible cash flow forecast. These forecasts are unlikely to prove fully accurate and need to be updated regularly, but they provide a firm basis for many business decisions – and what makes sense in business can also be relevant for personal finances.

Basing our predictions on what we can and can’t know

No matter what your personal circumstances, you have costs to meet now and in the future. While some of those costs might be certain, many will not be, and none of us can confidently predict the future.

Cash flow modelling forces us to make assumptions – but based on a detailed understanding of your circumstances, common sense and years of experience. A credible cash flow modelling exercise will take account of future inflation, saving and borrowing rates, and investment returns after allowing for costs. We also usually build in an assumed stock market crash, as one way of stress testing financial plans from an investment return perspective.

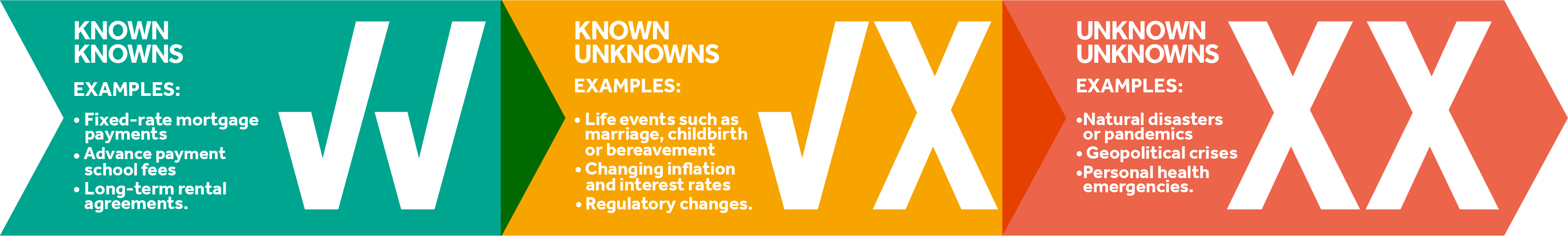

The late US politician Donald Rumsfeld’s often cited ‘uncertainty matrix’, can be adapted for cash flow modelling:

- Known knowns: These are the easiest costs to build into financial forecasts. They are generally fixed costs, such as living costs, that will have to be paid and are unlikely to change much in value in the future when allowing for inflation.

- Known unknowns: These are costs that might occur in the future, but we can’t be sure if or when they might happen, how much they’ll cost or what the knock-on effects might be. This is where financial modelling comes in. It enables us to make various assumptions to project future costs, based on a range of scenarios, and prepare meaningful cash flow projections.

- Unknown unknowns: This is the really challenging area for any attempt to look into the future, whether for financial planning or anything else. While we can’t ignore these risks, building a healthy contingency into any financial plan can provide a buffer against the unexpected. As by their nature ‘unknown unknown’ costs can’t be quantified, they present a problem for cash flow modelling, and it’s important to be realistic about what it can and cannot do.

Why use cash flow modelling?

Cash flow modelling is typically used:

- Identify whether long-term financial plans are on track or if you need to make any changes, such as increasing pension contributions if there is a retirement funding gap

- Consider whether you can afford to make gifts to family, friends or charities, while allowing for possible long-term care costs and any other ‘known’ risks

- Show the most appropriate way to cover long-term care costs, whether they’re already being incurred or about to start

- Consider the impact of paying education costs for children or grandchildren, and whether you’ll be able to sustain this until they graduate.

How do you present a cash flow model?

The way we present a cash flow plan varies and, wherever possible, we’ll design it to reflect your individual preference. You might want it shown as a graph, for example, or as figures in a table, or simply a summary in words.

Whatever format you choose, we’ll talk it through with you and make sure the results are plain to see. We’ll clearly show you any benefits and limitations, even though the underlying calculations can be complex, and we’ll take time to answer your questions and represent the figures in a different way if it makes it easier for you.

Could cash flow modelling work for me?

You may already be an Adam & Company wealth planning client and would like to use a cash flow tool to assess whether you are on track to meet your financial goals – or you may be thinking about consulting our expert independent advisers. Either way, we can create or refresh a plan to help you see the future with more clarity.

To create your individual cash flow plan, we start by asking you about your current financial situation, including outgoings and income, and establish an overview of your assets, including your property. Once we have a clear picture of your existing and future financial commitments and your goals, we can create your lifetime cash flow plan to help you achieve them.

Working with our independent Wealth Planners, the process can:

- Give you a snapshot of where your finances are right now

- Deliver an analysis of your current personal income and expenditure

- Bring your future to life by illustrating how your current situation and needs might change, while considering the impact on your income and expenditure throughout your lifetime

- Estimate your future cash flow

- Work towards achieving and maintaining financial independence

- Ensure you’ve made adequate provision for the financial consequences of death or disablement

- Plan to minimise your tax liabilities

- Develop or refine an investment strategy for your capital and any surplus income

- Highlight inheritance tax issues that could affect your beneficiaries

- Answer questions like: will my assets and savings be enough to support my aspirations? Do I have enough savings to retire early? Am I taking too much investment risk with my pension or other investments? Or will I run out of money?

Find out more

We see cash flow as a useful tool of financial planning, supporting our advice and evolving in line with your circumstances and objectives.

Talk to one of our independent Wealth Planners for a free cash flow planning consultation.

You may also be interested in:

- Making your money meaningful

- Are you up to date with the latest pension rule changes?

- Should I move additional cash into investments?

- Wealth planning: will you be able to afford rising care home costs?

Speak to our team in Edinburgh

If you are new to wealth management and would like to learn how this can benefit you, we can put you in touch with our team of experts that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.