Are investors right to be seduced by America’s AI giants?

This article was written by Richard Champion and originally published by CGWM.

More and more clients are asking us why they should bother buying UK shares at all, particularly given recent investment returns in the US. But even in this seductive environment, we remain cautious about completely abandoning the UK – or other markets for that matter.

In this article, our Co-Chief Investment Officer, Richard Champion explains what drives many UK investors to have an historical preference for their home market, and why investing in the UK still makes a lot of sense.

Why do many UK investors tend towards the UK market?

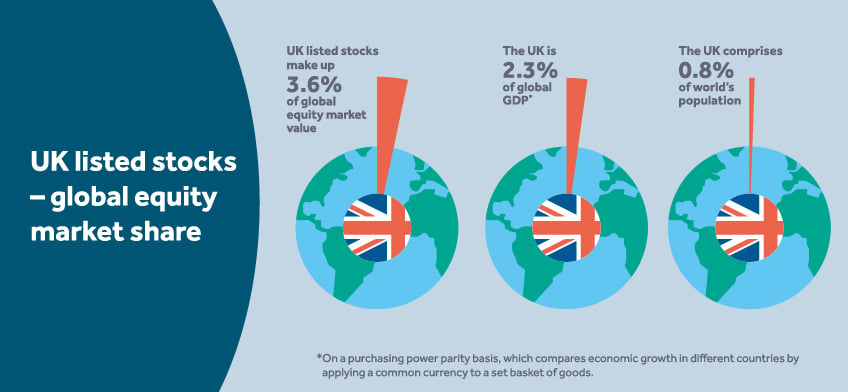

For many UK investors, their natural inclination towards the UK is often driven by tradition, simplicity in terms of taxation and dividends, and familiarity with the companies involved - after all, they often feature in our day-to-day lives. And given that a UK-based investor’s liabilities and spending are denominated in sterling, there is some sense in having assets in the same currency. This tendency has meant that, for a lot of private investors, UK shares constitute a much larger proportion of their portfolios than the UK’s weighting in the global market (fig 1).

Fig 1 UK listed stocks - global equity market share

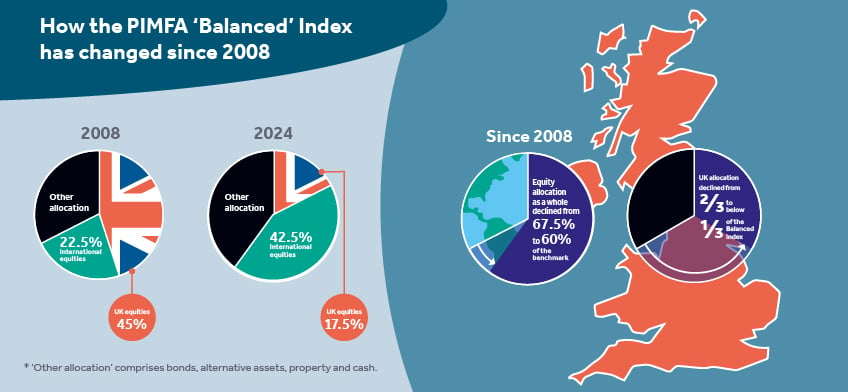

For the last 25 years, the Personal Investment Management and Financial Advice Association (PIMFA), the UK’s wealth management and financial advice trade association, has run benchmark indices to reflect the average approach to asset allocation across the wealth management industry. In general, these allocate around one third of equity exposure to the UK, and the remaining two thirds to shares outside the UK (fig 2).

Fig 2 PIMFA ‘Balanced’ Index asset allocation

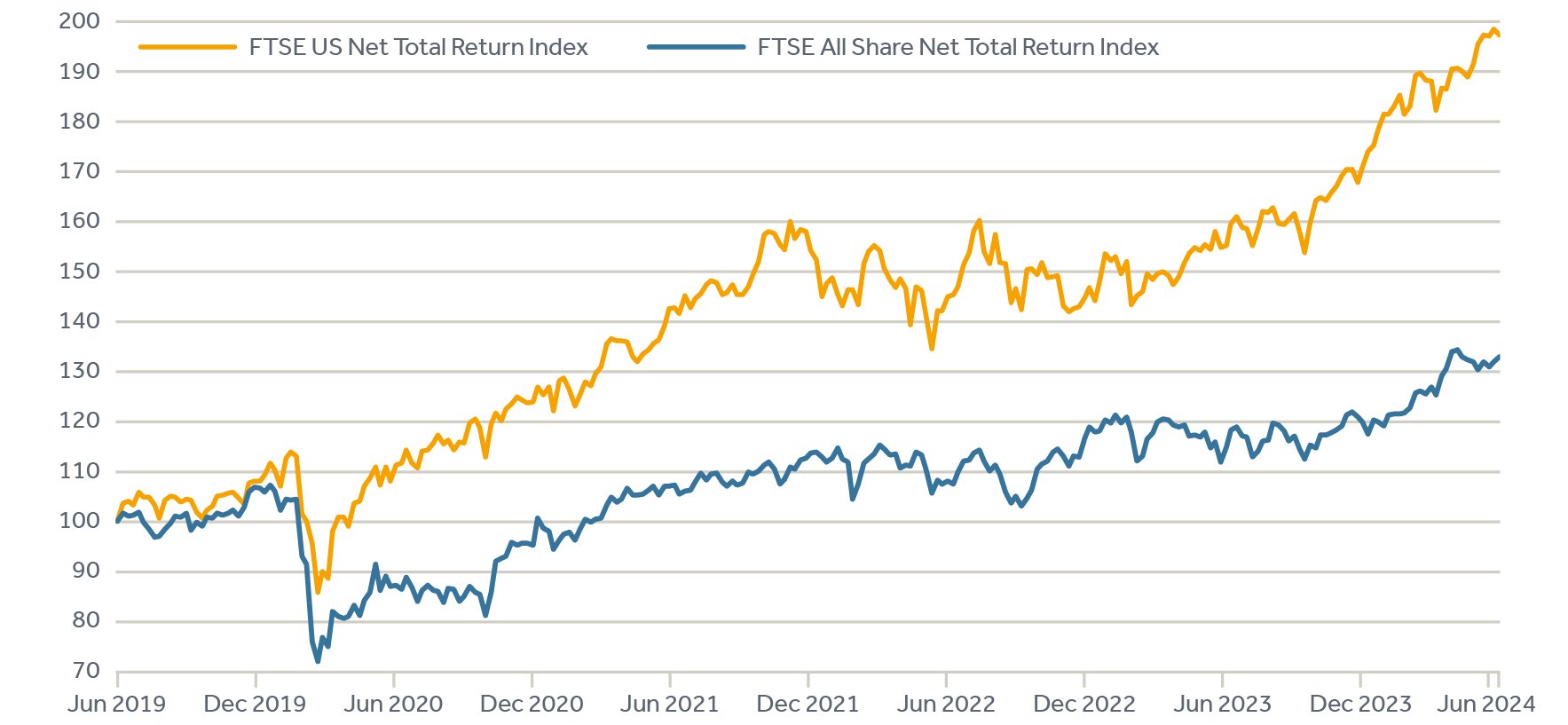

So, a lot of people have noticed that not being invested in the US market over the last few years has been an obstacle to keeping up with wider equity returns (fig 3). This reinforces the perception that having a big exposure to the UK (or even non-US markets) is an inefficient way to allocate capital – but is this the correct conclusion?

Fig 3 – US vs UK equity returns

Source: Canaccord, Bloomberg

What is driving returns in US markets?

Until recently, the divergence in investment performance between the US and other markets – including the UK – has grown wider. But this discrepancy was’t driven by the whole US market, it was focused on a very narrow range of companies – the so-called ‘magnificent seven’ (the mega-cap tech stocks, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla) – and a small number of others. Largely, these stocks have been driven by excitement over Artificial Intelligence (AI), a topic which we’ve discussed in the past. Yet, it’s worth repeating here just how narrow this market leadership and outperformance has been.

This narrowness has been brought into stark relief by recent market gyrations, where such companies have given back some of their extraordinary recent gains.

What’s happening to the rest of the US market, beyond the AI giants?

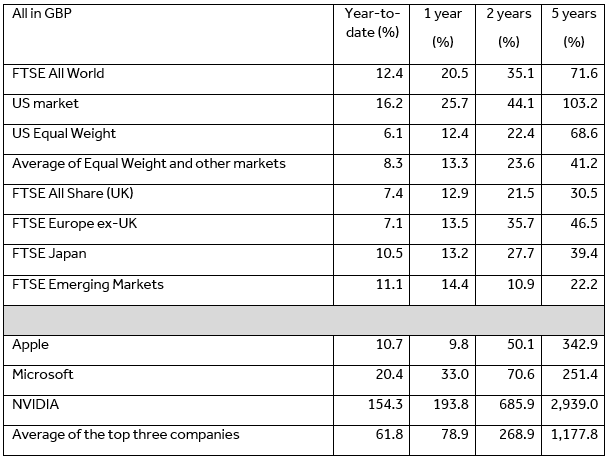

Let’s look at returns of the overall US market while taking into consideration that Microsoft, Apple and NVIDIA are all now valued between US$2.5trn and US$3trn each – and are all individually worth more than the entire value of the UK market (US$2.5trn).

If we strip out the performance of the ‘magnificent seven’ the average US company (as represented by the performance of the US Equal Weight index where all 500 components are given a weight of 0.2%) has been slightly below the average performance of the average of other markets year-to-date, one and two calendar years - although comfortably ahead of it over the last five calendar years.

In other words, the AI giants have been the only difference between investment performance of the UK and the US markets.

The average performance of the current top three companies by size has been far ahead of the rest. Over the last couple of years, NVIDIA alone has provided the largest contribution to US index returns ever recorded (fig 4).

Fig 4 Global market performance vs top three mega-cap tech stocks

Source: Canaccord, Bloomberg. Data as at 30 June 2024

How should the AI giants be positioned in client portfolios?

We must acknowledge that these companies are incredibly profitable, cash-generating machines, in a huge growth market, with massive balance sheet strength and massive competitive advantages due to their technologies and brands.

But, as investors, our challenge is that by most traditional valuation measures all these companies look expensive.

For instance, on a 12-month forward forecast price-to-sales basis (calculated by dividing the value of the company’s shares by the value of its revenues) Apple is 9x sales, Microsoft is 11x, and NVIDIA is 20x. 10x sales has traditionally been considered very expensive.

These high valuations leave us with a conundrum: if the US AI giants have been the only difference between the US and the rest of the world markets, we want to be careful not to throw the rest of the world markets out with the bathwater. With this in mind, how should we position our client portfolios from here?

Can common sense (and history) give us some guidance?

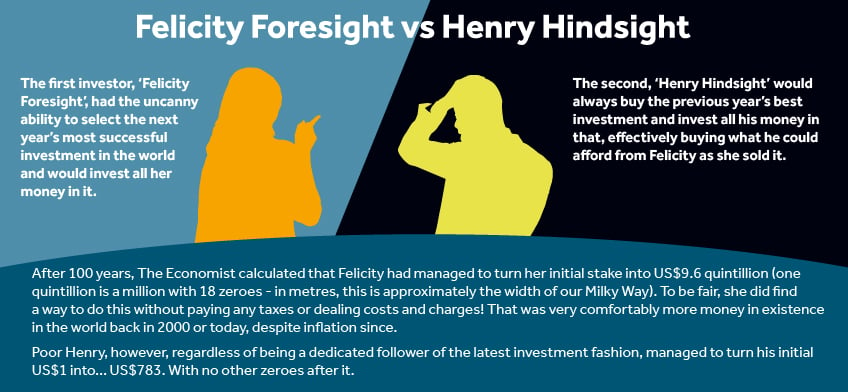

At the peak of the late 20th century technology investment bubble, articles written in The Economist magazine in late 1999 and early 2000, featured two very different investor stories.

Both started investing in 1900 with $1 and changed their investments at the end of each year. Being blessed with old age, they continued with their individual investment process every year for a century.

Chasing the latest investment ‘fashion’: what can we learn?

This parable shows the danger of getting drawn into momentum-driven investments, even when the underlying quality of the companies involved is undoubtedly excellent. Our aim is to build our clients’ wealth with confidence and buying expensive assets isn’t the best way to do this.

We do want some exposure to these AI leaders. After all, seismic technology changes like the development of steam power, railways, electricity, the telephone, the motor car, radio, the integrated circuit, the internet, and now AI, are very powerful things that don’t come along that often.

In the coming year we expect economic growth to moderate but not go into reverse; corporate earnings to remain robust, and inflation to behave well enough for central banks to start cutting interest rates. In this scenario, we expect the magnificent seven to at least pause for breath after their extraordinary rise and for the rest of the market to enjoy a better time catching up. Outside of the magnificent seven, valuations in markets are much more reasonable, which underscores their potential.

What does this all mean for client portfolios?

As one of the largest UK wealth managers (based on assets under management), with a strong performance track record of 20 years, we would always advocate a global asset allocation. We believe in genuine diversification and bias our equity investments towards ‘quality’ companies which we believe are the strongest and most profitable in the world - and seek to buy them at reasonable valuations, irrespective of where they are listed.

But we believe there are good opportunities in the UK, Japan and emerging markets, especially after the turbulence we have seen in the last couple of weeks. We also believe that plenty of parts of our favoured quality style (sustainable highly profitable companies with strong balance sheets) are showing good value, especially in the unloved consumer staples area. We even think that there are some good opportunities in the US outside the current leaders.

The magnificent seven are all well and good, but after the huge gains they’ve seen, we’d rather leave a decent amount of their immediate future to the Henrys of this world. You may still consider that one third of your equity investments in the UK is a little high, but right now we’re happy to run with that.

Any questions?

If you have any questions about the current market and economic environment or your asset allocation within your portfolio, please get in touch with us.

For further information on any of the terms used in this article please see our glossary of investment terms.

Investment Outlook August 2024

Read our latest Investment Outlook to discover if election fever will help or hinder investment opportunities?

You may also be interested in:

- Summer webinar: Has election fever positively impacted our client portfolios?

- Japan – is it finally hitting the right notes?

New to Adam & Company Wealth Management?

If you are interested in finding out what the latest investment outlook means for you, we can put you in touch with an expert that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Adam & Company makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Adam & Company is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Adam & Company is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.